Table Of Content

Being able to make a sizable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Mortgage calculator terms explained

You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you don’t wish to use NerdWallet’s estimates. Edit these figures by clicking on the amount currently displayed. An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home.

How to use the mortgage calculator

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria. In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology. Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage (hail, wind and lightning) to your home.

Veteran Home Loan Center

The monthly payment calculator above will give you an idea of the cost of a basic loan. But you may also want to use a loan calculator that is more tailored to your needs. An extra payment is when you make a payment in addition to your regular monthly mortgage payment. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. Here’s a guide to the information you’ll need in order to use the monthly payment calculator and definitions for some of the terms you'll come across. If you’re hoping to buy a home, weeks or months could pass before you find a house and negotiate your way to an accepted offer.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your home’s value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services. A mortgage is an agreement between you and the company that gives you a loan for your home purchase.

Start your home buying research with a mortgage calculator

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association (HOA) fees to collectively pay for amenities, maintenance and some insurance.

Mortgage payment formula

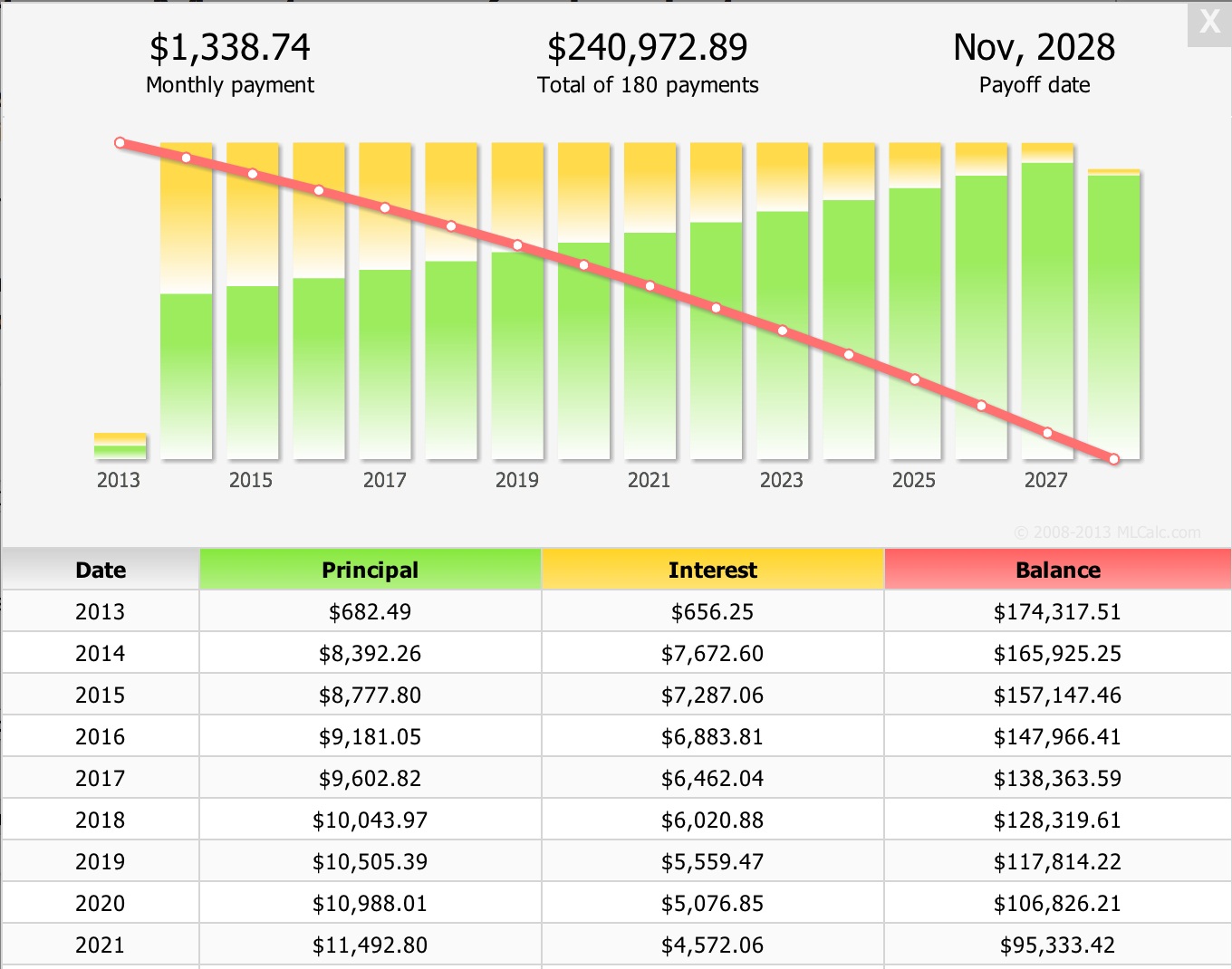

These four key components help you estimate the total cost of homeownership. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. You start by paying a higher percentage of interest than principal. Gradually, you’ll pay more and more principal and less interest.

USDA loan (government loan)

Most people choose 30-year fixed-rate loans, but if you’re planning on moving in a few years or flipping the house, an ARM can potentially offer you a lower initial rate. For the mortgage rate box, you can see what you’d qualify for with our mortgage rates comparison tool. Or, you can use the interest rate a potential lender gave you when you went through the pre-approval process or spoke with a mortgage broker.

How Much Is A Down Payment On A House? - Bankrate.com

How Much Is A Down Payment On A House?.

Posted: Tue, 09 Apr 2024 07:00:00 GMT [source]

This influences which products we write about and where and how the product appears on a page. By 2001, the homeownership rate had reached a record level of 68.1%.

This rule says that your mortgage payment shouldn’t go over 28% of your monthly pre-tax income and 36% of your total debt. This ratio helps your lender understand your financial capacity to pay your mortgage each month. The higher the ratio, the less likely it is that you can afford the mortgage. SmartAsset’s mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you will pay each month. Here’s a breakdown with an explanation of each factor and how it influences your payment.

The reason most lenders require a 20% down payment is due to equity. If you don’t have high enough equity in the home, you’re considered a possible default liability. In simpler terms, you represent more risk to your lender when you don’t pay for enough of the home. One common exemption includes, VA loans, which don’t require down payments, and FHA loans often allow as low as a 3% down payment (but do come with a version of mortgage insurance). One of the rules you may hear as a homebuyer is the 28/36 rule or the debt-to-income (DTI) rule.

When a loan exceeds a certain amount (the conforming loan limit), it's not insured by the Federal government. Loan limits change annually and are specific to the local market. Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing. When you own property, you are subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

The more info you’re able to provide, the more accurate your total monthly payment estimate will be. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios. If you have excellent credit with a 20% down payment, a conventional loan may be a great option, as it usually offers lower interest rates without private mortgage insurance (PMI). You can still obtain a conventional loan with less than a 20% down payment, but PMI will be required. For example, you may have homeowners association dues built into your monthly payment. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up.

No comments:

Post a Comment